Deep Value Radar — October 2025

Hidden value in plain sight

FRAGMENTS

Oct 17 ∙ Paid

Every month we scan for deep value — assets, cycles, catalysts.

Think of it like a flight radar: we’re not staring at the pretty skies, we’re hunting for turbulence hiding under the clouds.

The goal is simple: catch names the market throws away because the story looks ugly while the math screams mispriced.

Here’s a glimpse of this month’s radar part 2👇

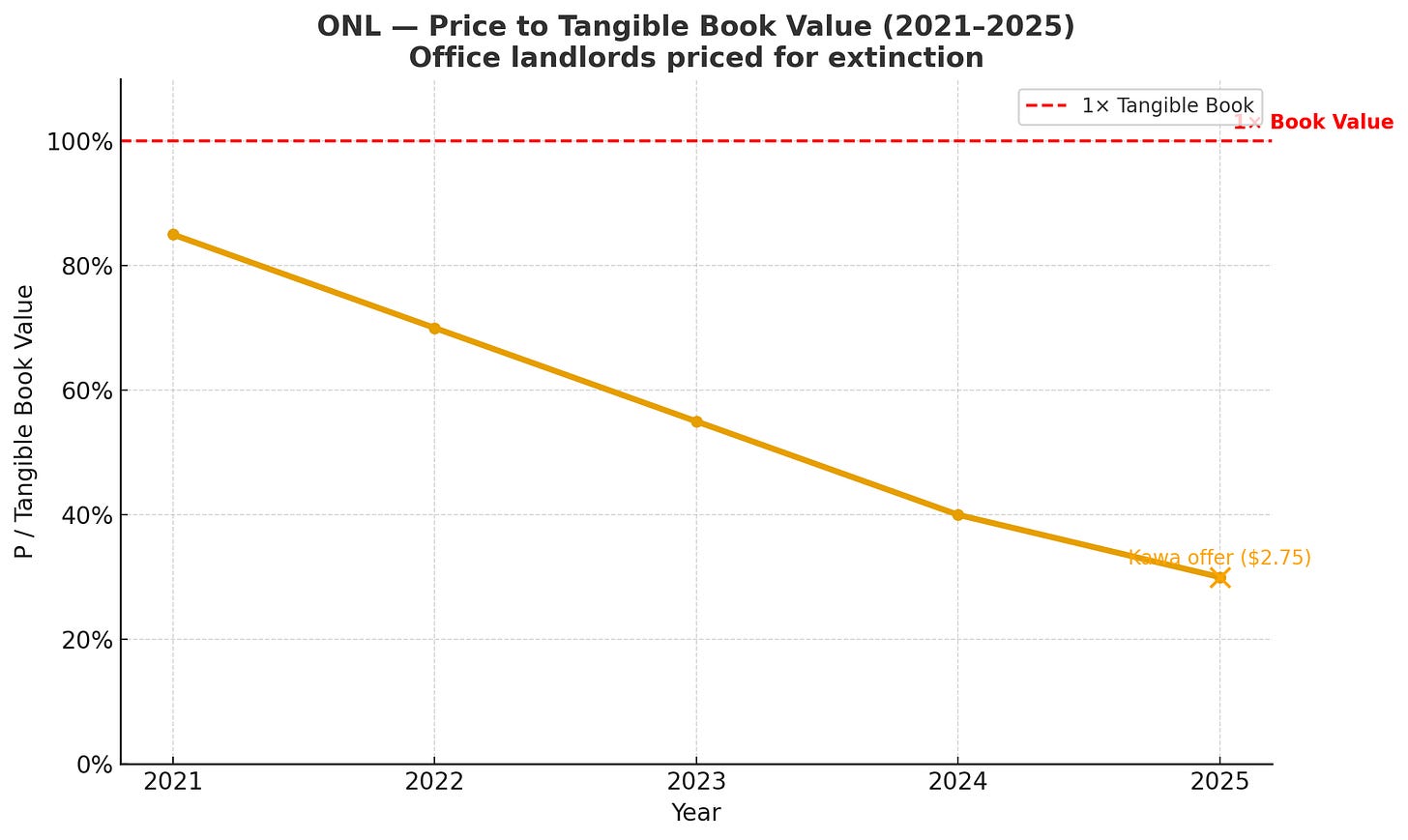

One Chart That Matters

📊 Office landlords are priced for extinction — ONL trades far below tangible book, as if every lease disappears tomorrow.

Why it matters: real estate is cyclical, not terminal.

Between the lines: when pessimism turns into policy, cash buyers start circling.

🆓 Free today — Two names from this month’s radar.

(No favorites. Just math, assets, and patience.)

Free Preview

Orion Office REIT (ONL)

Thesis: pure-play office landlord spun from Realty Income, trading at a deep discount to its asset base.

Why mispriced: Street assumes structural vacancy = terminal decline.

Catalyst: lease renewals, selective asset sales, and deleveraging.

Floor: tangible book + cash + property value > market cap.

Change my mind if: renewals stall and disposals clear below debt.

Mini Scenario Map

Bear: persistent roll-downs → NAV erosion continues.

Base: renewals stabilize → re-rating toward tangible book.

Bull: disposals above carrying value → upside torque ×2–3.

Fresh catalyst: in July 2025, ONL received — and rejected — an unsolicited buyout offer from Kawa Capital ($2.50 → $2.75 per share).

Even rejection confirms the market’s mispricing: someone’s running the numbers.

Between the lines: a bid makes the floor real.

Vera Bradley (VRA)

Thesis: heritage lifestyle brand with net cash and under-monetized intellectual property.

Why mispriced: consensus treats it like a mall fossil.

Catalyst: brand collaborations, e-commerce rebuild, licensing expansion.

Floor: cash ≈ market cap + IP (trademarks, design rights, royalty streams).

Change my mind if: brand loses pulse and royalties fade.

Mini Scenario Map

Bear: fatigue persists → slow bleed.

Base: modest licensing rebound → profit stabilizes, stock doubles.

Bull: collabs hit → franchise revival, equity torque ×3.

Insider check: insiders hold ≈ 28 % of shares; Director Andrew Meslow bought ≈ 253 k shares in June 2025 at $1.88 — quiet conviction in public view.

Between the lines: when insiders accumulate during silence, they’re not hoping — they’re calculating.

📌 Coming Friday

🚨 Deep Value Report: CABO

Exclusive to Premium. Replacement-cost math, local-monopoly economics, and the hidden asset floor no screen shows.

Why it matters: Cable One’s network would cost ≈ $9 B to rebuild — yet the stock trades near $3.8 B market cap.

And Donald E. Graham (The Washington Post heir) remains a disclosed shareholder (Form 13D/A).

Between the lines: the market thinks cable is dying — but dead things don’t keep throwing off cash.

👉 Upgrade before Friday to unlock the full CABO report + 9-name cockpit.

🔒 Below the Fold (Premium) — full cockpit notes, scenario ladders & catalysts.

This is where the math meets the mispricing.

Don’t fly blind — upgrade to PLUS now.