DEEP VALUE REPORT — GOODYEAR (GT)

Hidden Value in plain sight

THESIS (full read)

Goodyear isn’t a “tires = auto cycle” punt anymore. It’s self-help → cash → de-lever. In 2025, they sold the right non-core pieces (OTR mining/construction, Dunlop brand rights, Chemical) for roughly $2.2B gross—and started using it to take the debt story out of the stock. At the same time, the Goodyear Forward program is translating into real, dated savings, marching toward a $1.5B annualized run-rate by year-end 2025. Q3 looked messy in GAAP (non-cash $1.4B DTA (deferred tax asset) allowance + $674M goodwill impairment), but the operating tape is the tell: SOI ( Segment Operating Income) positive with sequential improvement, divestitures completed, and deleveraging already in motion. Media | Goodyear Corporate

Between the lines: This is a balance-sheet tax being lifted by receipts, not promises.

CONTEXT (five-year rewind to now)

2021–2023: penalty box. Cooper deal added leverage; raws whipsawed; cheap imports hit replacement; ratings pressure stacked up.

2023–2024: Elliott pressure → board refresh, operator CEO, and a formal Forward playbook with dated milestones. Portfolio surgery announced.

2025: they actually did the surgery. Three divestitures closed; proceeds pointed to debt; Forward savings showing up in the SOI bridge. GAAP optics ugly, but non-cash—exactly what you want if the cash is about to arrive in Q4. Media | Goodyear Corporate

Between the lines: Quiet execution and loud narratives.

ANALYSIS

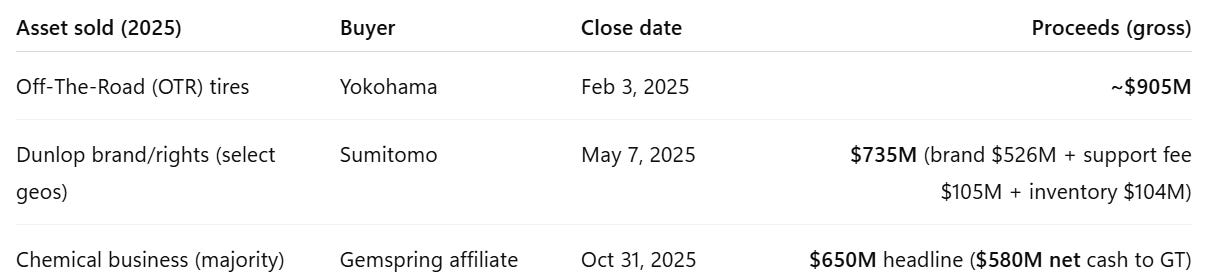

A) What they monetized (cash that already hit reality)

Gross divestitures ≈ $2.2B earmarked for debt reduction under Forward. Media | Goodyear Corporate+2Media | Goodyear Corporate+2

Between the lines: They sold low-multiple, non-core first and kept the premium engine. Sequencing matters.

B) What remains (the engine + the real “hidden” options)

Premium core: ~1,000 new SKUs (Stock Keeping Unit) rolling; price/mix doing the work; OE ties keep pipelines credible (keeps the premium narrative intact).

Global footprint: aligned toward higher-margin replacement over time.

Retail/service network (~800 sites): optional sale-leaseback or carve-outs if needed. Not required for BASE; that’s upside convexity.

Between the lines: We treat hidden options as insurance, not as valuation glue.

C) Q3-2025 receipts

These line items come straight from GT’s release and slide deck today. Media | Goodyear Corporate+1

Between the lines: We’re past story-time. This is a receipts-tape.

D) Peer snapshot

Between the lines: Context kills the “nice story” critique.

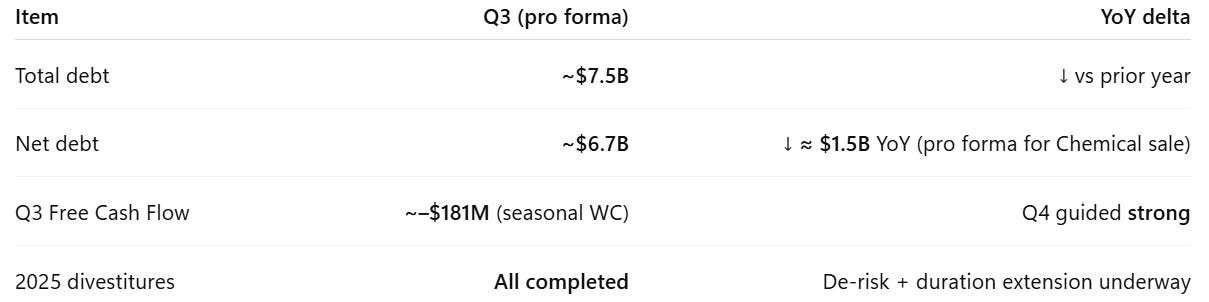

E) Balance-sheet & cash snapshot

Debt down ~$1.5B YoY on a pro-forma basis per company slides; Q4 FCF emphasized as “strong.” corporate.goodyear.com

Between the lines: The big de-risk is already done but the stock hasn’t fully moved.

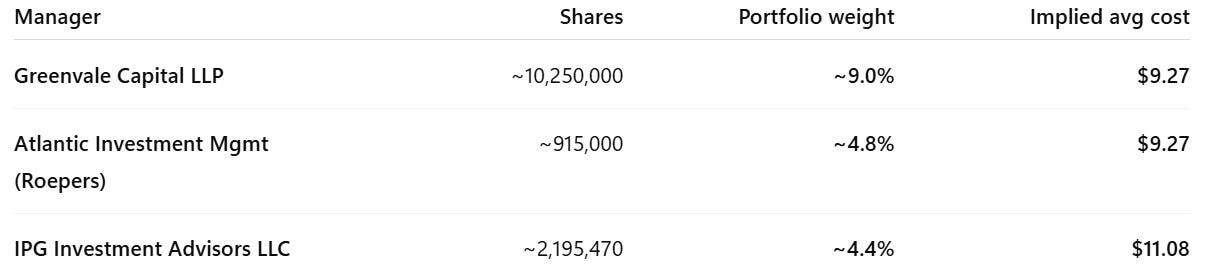

F) Who actually holds the whip (ownership, insiders, flow)

High-conviction managers I flagged (13F, 30-Jun-2025):

These are skin-in-the-game holders aligned with the delever + self-help arc. No board seats (the board refresh came via Elliott in 2023), but soft-power governance still matters: they’re natural “add on weakness / trim on receipts” hands.

Between the lines: They have more to lose than me

⛳️ PAYWALL :(

Unlock the cockpit → Conversion math (why GAAP EPS jumps in steps), the integrated hidden-assets audit, peer & debt visuals, raws/tariffs sensitivity, our prove-it checklist, richer Catalysts/Risks, and the valuation table (BEAR/BASE/BULL)—plus the full conclusion.

Upgrade to PLUS to get the numbers and triggers.

Keep reading with a 7-day free trial

Subscribe to Cundill Deep Value to keep reading this post and get 7 days of free access to the full post archives.