DEEP VALUE REPORT — SUMMIT HOTEL PROPERTIES (NYSE: INN)

Hidden Value in plain sight

INN is priced like a hotel owner that can’t refinance cleanly and won’t see demand normalize fast enough.

At ~$4.6, the tape is basically saying: “nice portfolio, but the capital stack owns you.”

The filings say something more specific: this is a real portfolio (~95 assets / 14,347 keys), run like an operator, with active balance sheet wiring — asset sales + repurchases + refi sequencing — and the entire outcome is dominated by how cleanly the 2026 wall gets handled.

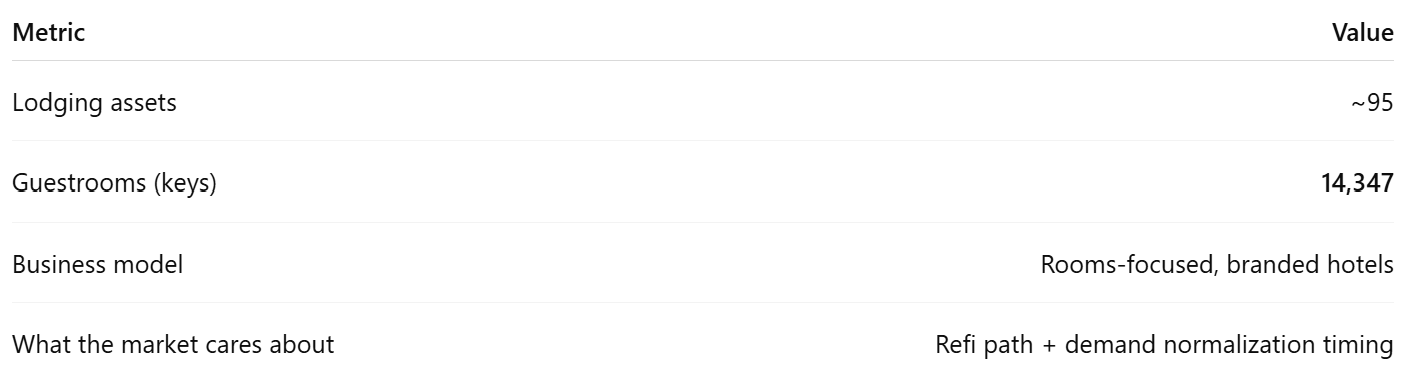

1) What INN actually is

Summit Hotel Properties is an upper-upscale / upscale / upper-midscale lodging REIT. The balance sheet makes the business simple: it is still, overwhelmingly, a hotel-asset machine.

Portfolio snapshot

The operational story (and why the market is still skeptical) is not “portfolio broken.” It’s “demand got annoying + pricing got sensitive + booking windows narrowed,” while operators squeezed market share and expenses.

What management described (Q2/Q3 2025 tone)

The market isn’t debating whether the hotels exist. The market is debating whether the common survives the stack cleanly through the window.

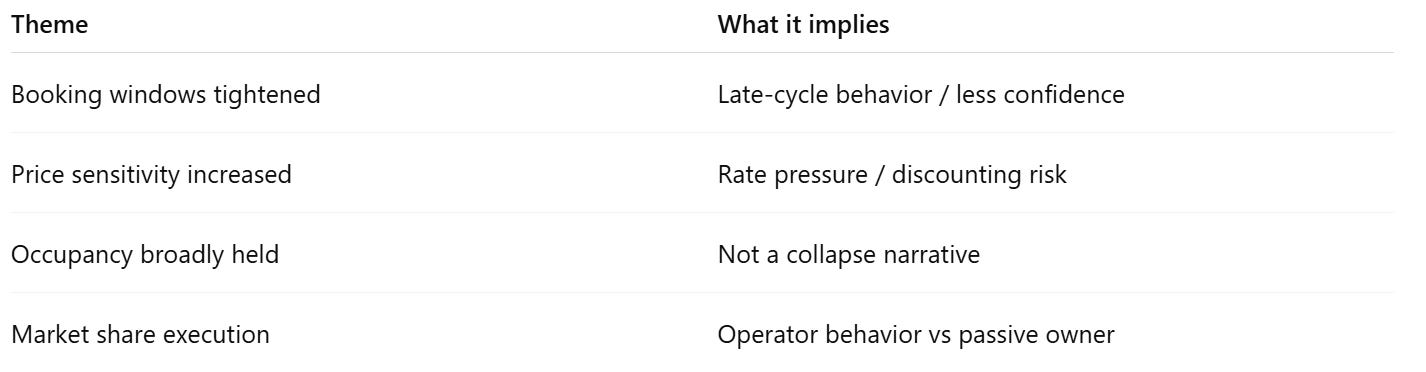

2) Balance sheet snapshot

This section is intentionally ledger-first. If the ledger isn’t clean, nothing below matters.

2A) Balance sheet anchors (as of Sept 30, 2025)

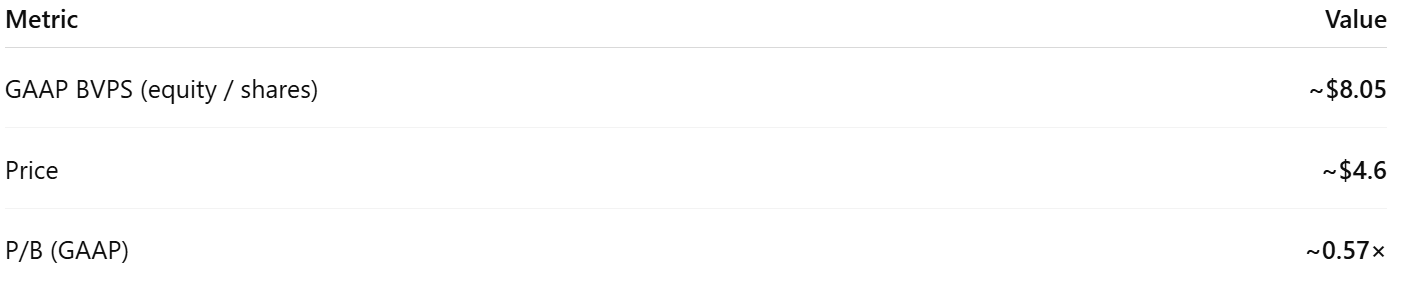

2B) Quick per-share ledger (GAAP)

That ratio is the signal: the market is screaming balance sheet / maturity risk, not “the hotels are fake.”

Everything below is the full asset ledger, replacement-cost lens, capital stack waterfall, insider + fund holder grid, call extraction, five-year rewind, BEAR/BASE/BULL valuation map, and the explicit “what breaks it” section.