DEEP VALUE REPORT — UPDATED, PART 2 — $ASTL

Algoma Steel Group (ASTL) — “Tariffs, Green Steel and a C$500m Lifeline”

0. The one-page version (what changed since Part 1)

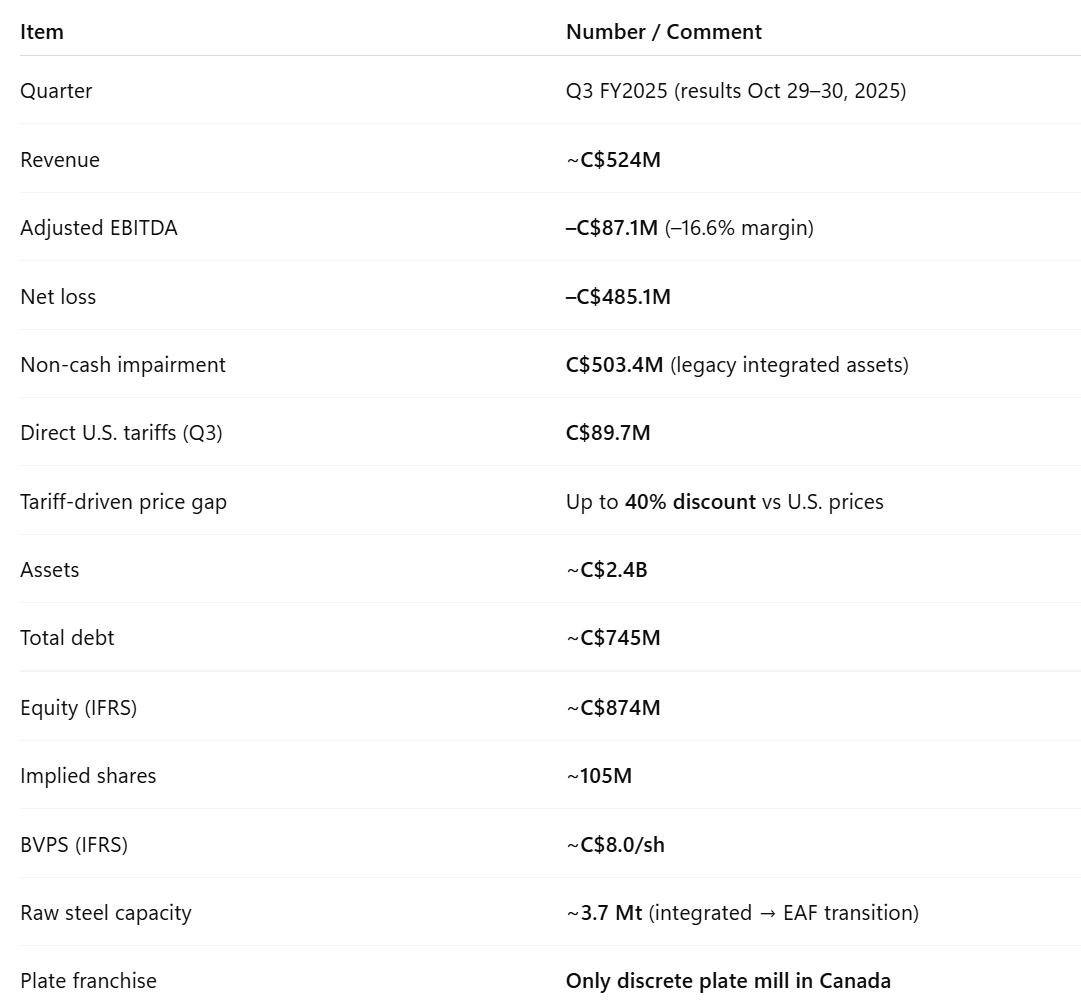

Q3 2025 made the pain visible.

Algoma’s Q3 was brutal on the income statement:

Net loss: C$485.1M, vs C$106.6M loss a year ago.

Driven mainly by a C$503.4M non-cash impairment on legacy integrated assets.

Adjusted EBITDA: –C$87.1M (–16.6% margin).

Direct U.S. tariffs in Q3: C$89.7M.

On top of that, U.S. tariffs have pushed Canadian prices up to ~40% below U.S. levels, costing another ~C$32M in Q3 and ~C$62M year-to-date.

But three structural things shifted in your favour:

Tariff shock is now fully recognized.

The impairment + P&L finally reflect the full economic impact of the prolonged tariff regime. The “ugly” is largely on the table.Government money went from rumour to paper.

Ottawa + Ontario are now formally in with a C$400M + C$100M 7-year loan package under the Large Enterprise Tariff Loan (LETL) facility, plus 6.77M 10-year warrants at C$11.08.The thesis is now clearly plate + green EAF.

Algoma is Canada’s only discrete plate producer – that’s now front-and-centre in every press release.

The EAF transition (3.7 Mt raw steel capacity) is real, not aspirational: first arc + first steel already achieved, ramp in progress.

Deep value angle (updated):

IFRS equity is ~C$874M; total debt ~C$745M; assets ~C$2.4B.

Share count implied by ownership tables is ~105M shares.

IFRS BVPS ≈ C$8; the stock trades at a meaningful discount to that (sub-0.7× book) and well under replacement cost of the footprint (3.7 Mt green EAF + plate + port).

Our updated Deep Value “NAV” work (below) lands around C$12/sh in a Base world, with an asset-based Bear around C$8–9 and Bull around C$16. On top of that, we lay an earnings-based Bear/Base/Bull map:

Bear (earnings / sentiment): C$5–7/sh

Base: C$10–14/sh

Bull: C$17–22/sh

Between the lines: The market is trading the income statement (loss, impairment, tariffs, new loans), while the deep-value edge is in the balance sheet and franchise: Canada’s only plate mill, a nearly C$1B EAF project, a strategic port footprint and a C$500M government backstop — all at a fraction of tangible value.

1. Quick snapshot — Q3 2025 cockpit

(All figures approximate, CAD unless noted; Q3 FY2025 press release + MD&A.)

Between the lines: On paper, you’re looking at a levered, loss-making steel mill with a huge impairment. In reality, you’re sitting on a strategic 3.7 Mt EAF + plate platform that Ottawa just decided is too important to let fail.

2. Government package – what Ottawa and Queen’s Park actually signed

This isn’t some vague “maybe we’ll help.” It’s now papered and funded.

2.1 Structure — Large Enterprise Tariff Loan (LETL) + Ontario

From federal and provincial releases + Algoma’s own announcement:

Total support: C$500M

Warrants

6.77M share purchase warrants, 10-year term, strike C$11.08.

Split between Ottawa and Ontario; exercisable into ASTL equity if the thesis works.

Policy language (not just PR):

“Help Algoma Steel continue operations, transition to a business model less reliant on the United States, and limit disruption to its 2,500 full-time jobs.”

2.2 What this really means, economically

It’s not a grant.

This is debt with equity-like upside via warrants. Algoma will pay interest and eventually repay/refinance.It dramatically reduces near-term survival risk.

Before this, the combo of tariff shock + EAF capex + thin cash made any downturn scary. Now you have C$500M of committed liquidity plus ABL.It introduces a warrant overhang rather than immediate dilution.

At today’s price, the warrants are far out-of-the-money. Dilution only bites if the thesis succeeds enough to push shares toward or above C$11.08.

Between the lines: From a deep-value lens, this is rescue capital on friendly terms. The government’s downside is your downside. They don’t want to own a closed mill; they want a running, modernized plate + EAF hub.

3. The asset footprint — what you actually own

Forget the Q3 loss for a second. What’s the machine?

3.1 Steel footprint

From corporate profile, CBSA filings and government support docs:

Raw steel capacity: ~3.7M tons per year.

Finished steel capacity: ~3.4M tons per year.

Discrete plate mill:

Only one of its kind in Canada.

Upgraded via “Plate Mill Modernization” (Phases 1 & 2 completed by 2024).

Used for Royal Canadian Navy ships, Coast Guard, infrastructure, energy, mining, heavy manufacturing.

Direct Strip Production Complex (DSPC):

One of the lowest-cost hot-rolled sheet producers in North America, integrated with the new EAF path.

3.2 EAF decarbonization project (nearly C$1B)

From Algoma’s decarb disclosures and Q3 presentation:

Project scope:

Replace two blast furnaces and related coke/ironmaking with electric arc furnaces + secondary metallurgy.

Target: 70%+ CO₂ reduction vs legacy route, at similar output levels.

Capex:

Total project expected around C$900M–C$1B range.

As of Q3, most of this is already spent and capitalized, with first arc and first steel achieved and ramp ongoing.

Economics (directionally):

EAF route is structurally lower-cost per ton at scale than the old BF/BOF route.

It also opens the door for “green plate” premia in defense/infrastructure tenders.

3.3 Port, land, logistics

Algoma sits on:

A deep-water Great Lakes port in Sault Ste. Marie.

Rail and road links into Ontario and the U.S. Midwest.

A large industrial land footprint with existing environmental permits and infrastructure.

This is hard to replicate today. Permitting and NIMBY alone would eat years. Yet the whole equity sits at a fraction of IFRS book, itself already reduced by the impairment.

Between the lines: You’re not buying “a bad quarter.” You’re buying a strategic, decarbonizing steel platform with port and plate monopoly characteristics — at a price where the market prices in permanent tariff misery.

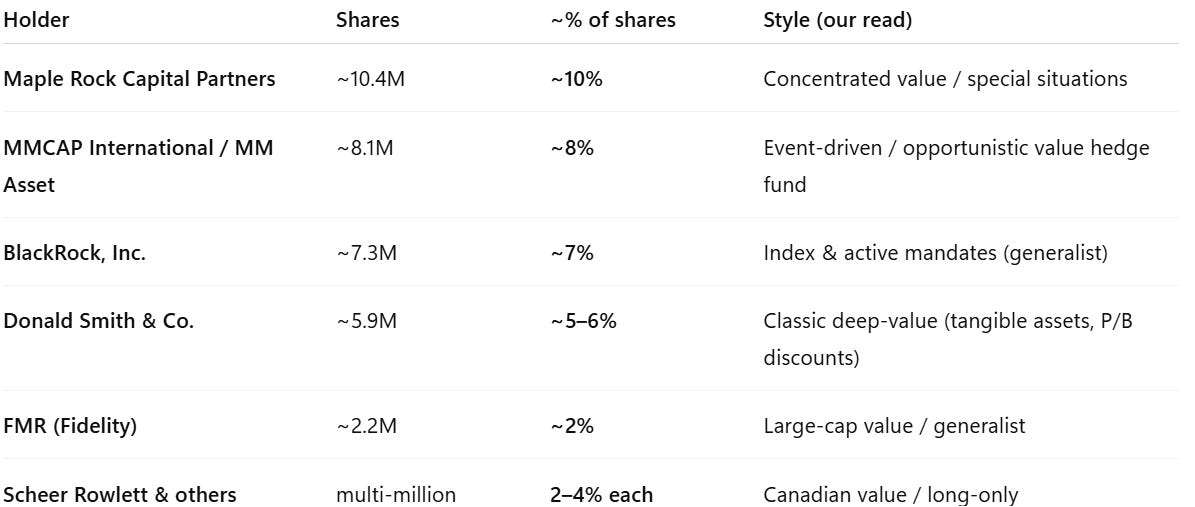

4. Who are you sitting next to? (Shareholder base)

We bring back the part you liked: who owns what, and what kind of money they are.

Using ownership snapshots for Sept 30, 2025:

4.1 Top institutional holders (approx.)

Total institutional: >75% of float. Retail is a minority.

(Ownership percentages based on MarketScreener, Yahoo, and investor-profile data for Sept 2025; shares outstanding implied ~105M.)

4.2 What that actually tells you

You are not alone as a deep-value investor.

Names like Donald Smith & Co. are hardcore value players – they live on low P/B and asset plays.Maple Rock / MMCAP are not “tourist ETF money.”

They are concentrated, event-driven, value-oriented funds. They don’t sit in names like this for fun; they’re explicitly betting on mispricing + catalyst.BlackRock / FMR add depth and liquidity.

Having big platforms in the register helps with index inclusion, liquidity and lending, but they’re not your thesis partners.

Between the lines: The register is crowded with value and event capital. If the story plays out (tariffs ease, EAF ramps, plate monetizes), these holders will likely push for deleveraging, buybacks, or strategic alternatives rather than complacency.

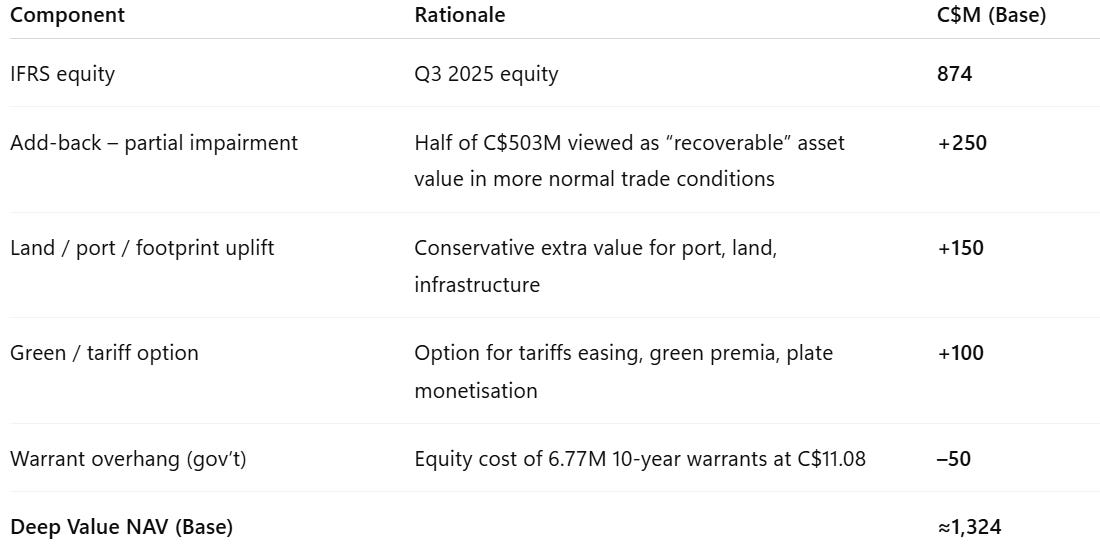

5. Deep Value “NAV” today — SOTP (high-level)

Now we do what almost nobody bothers to do on a small Canadian steel name: sum-of-the-parts on the asset base.

Numbers are illustrative, not exact appraisal values. The point is order-of-magnitude, not false precision.

We anchor on IFRS equity, then adjust.

5.1 SOTP — Base case “today” (Deep Value NAV)

(All CAD, rough; per share using 105M shares.)

Assumptions:

IFRS equity already includes the C$503M impairment, so the book is “hair-cut” vs pre-tariff.

We add back a portion of that impairment, recognizing some economic value remains in legacy assets and site footprint.

We uplift for land/port/footprint and for the “green / tariff option.”

We subtract for warrant overhang and conservative stress.

Per share (105M shares):

Base NAV ≈ C$1,324M / 105M ≈ C$12.6/sh

So in our Base world, “asset value” is around C$12–13/sh. The market price is implying a ~50–60% discount to that.

Between the lines: Even if you chop our adjustments by one-third, you still get something around C$9–10/sh NAV versus today’s quote. That’s why this is deep value, not a story stock.

Everything below this line is for paid readers only:

📊 Full salvage-value ledger — assets vs liabilities, line by line

🧮 Bear / Base / Bull SOTP per share — what the asset map looks like in each world

📈 Scenario matrix — earnings power vs asset value, side by side

🧱 Stress tests — tariffs, EAF ramp, balance sheet and policy shocks

No portfolio advice — just the full cockpit.

Keep reading with a 7-day free trial

Subscribe to Cundill Deep Value to keep reading this post and get 7 days of free access to the full post archives.