Mercer International (MERC) — Deep-Value Report Premium

Full Edition

Executive Summary

Mercer International stands at the intersection of forestry, energy, and industrial recycling — and right now, the market is pricing it as if all three were in terminal decline. In reality, the company operates high-efficiency pulp mills in Europe and Canada, a solid-wood division, a growing mass-timber platform in North America, and a renewable-energy segment producing steady power.

Where others see leverage and cyclicality, Fragments sees hard assets with optionality. Mercer’s infrastructure is expensive to replicate, anchored by decades of fiber rights, power contracts, and industrial land. The current share price near 3 USD values the firm like a liquidation — yet replacement cost easily exceeds 20 USD per share.

Our work rebuilds the company asset by asset, applying the logic of Peter Cundill’s margin-of-safety discipline: count what can be counted, pay pennies for tangible value, and wait for mean reversion.

Company Overview

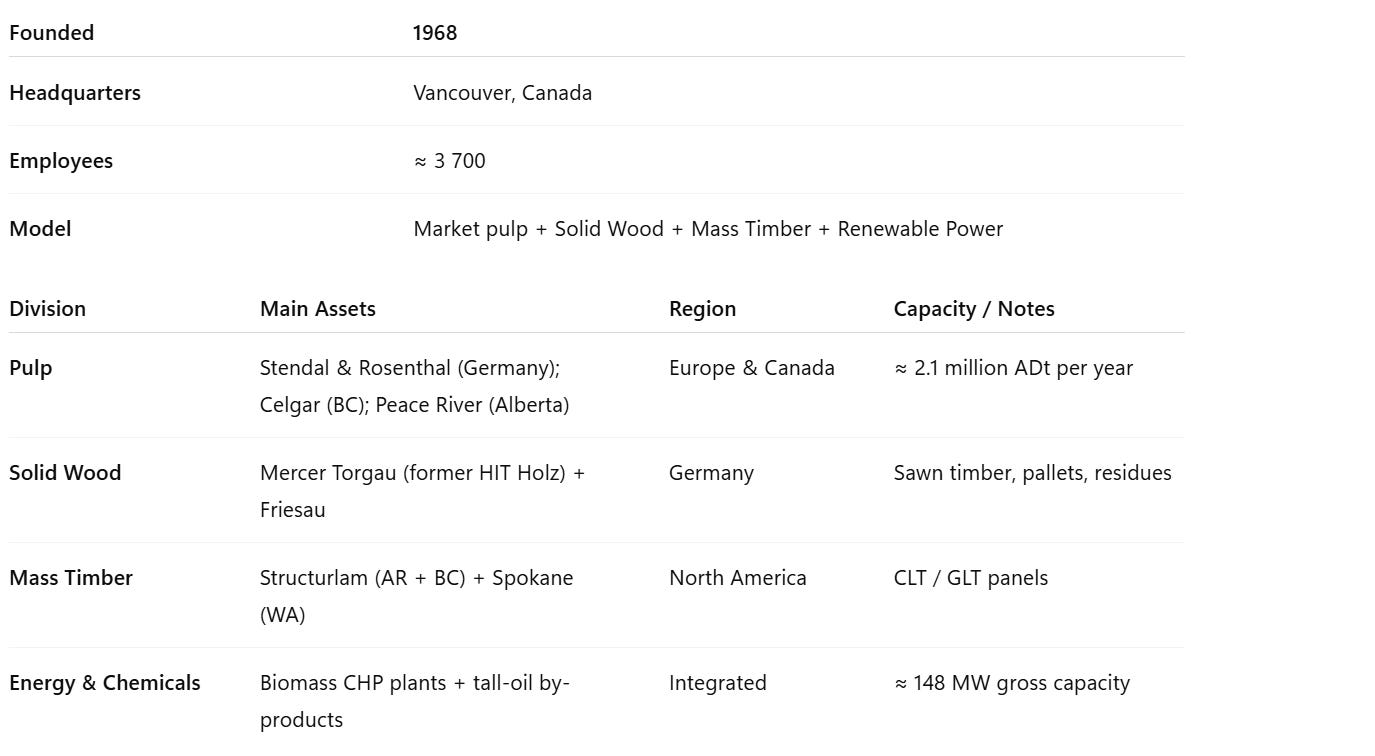

Founded1968HeadquartersVancouver, CanadaEmployees≈ 3 700ModelMarket pulp + Solid Wood + Mass Timber + Renewable Power

The company also holds ≈ 730 acres of industrial land and long-term forest-management agreements in Alberta covering ≈ 2.7 million hectares — ensuring sustainable fiber supply far into the 2030s.

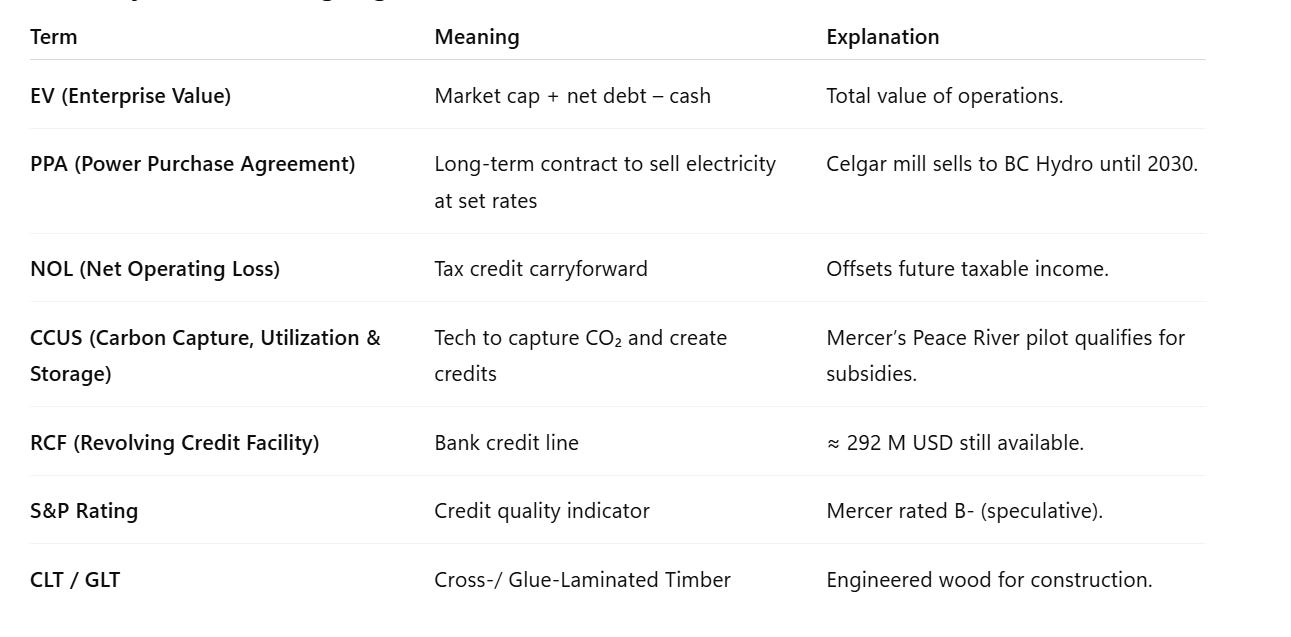

Glossary — Plain Language

Recent Developments (2024 – 2025)

Revenue (Q2 2025): ≈ 453.5 M USD (–9 % y/y)

GAAP Net Loss: 86 M USD (–1.29 USD per share)

CapEx cut: ≈ 100 M USD; Dividend suspended

Cost Program: “One Goal, One Hundred” → target 100 M USD savings by 2026

Liquidity: 146 M USD cash + 292 M USD RCF availability

Debt: ≈ 1.5 B USD @ 10–11 % average rate

New notes: 200 M USD @ 12.875 % due 2028

Tone of Conference Calls — Professional, disciplined, and realistic.

CEO Juan Bueno speaks of operational discipline; CFO David Short emphasizes liquidity and optional debt management. Analysts pressed on refinancing and cost inflation; management answered plainly. No spin, no promises — just a message: stay solvent, wait for the turn.

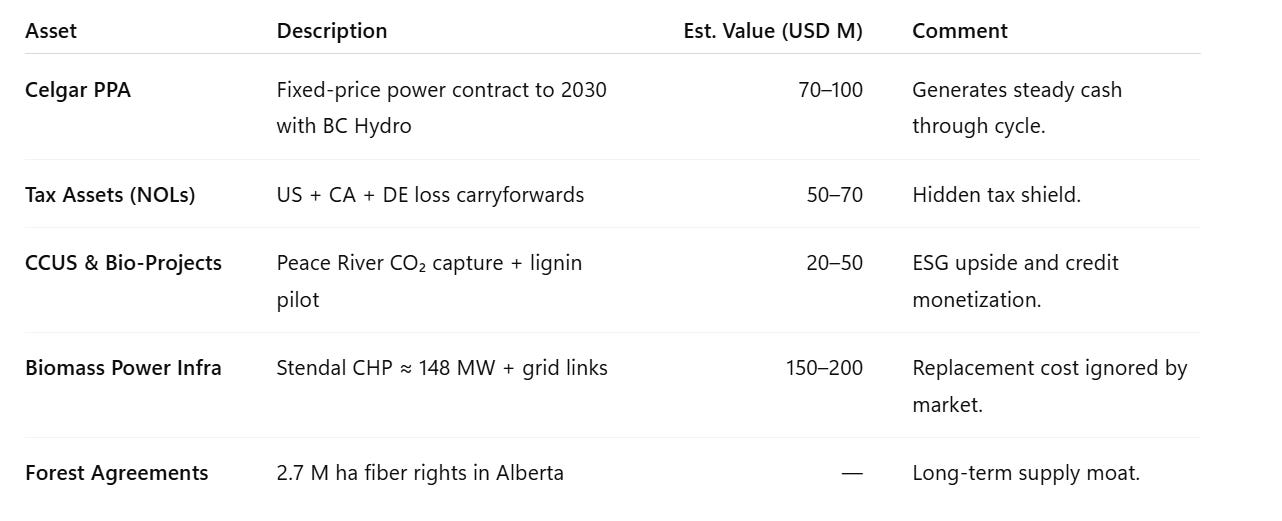

Hidden Assets

Total hidden economic value ≈ 250–350 M USD.

Balance Sheet & Liquidity

Total Debt: ≈ 1.5 B USD

Cash: ≈ 146 M USD

Net Debt: ≈ 1.35 B USD

RCF Availability: ≈ 292 M USD undrawn

Next Maturities: 2026 → 2028 → 2029

Rating: B- (S&P)

The RCF is Mercer’s oxygen supply — enough to survive a 12-month pulp trough without fire-sales.

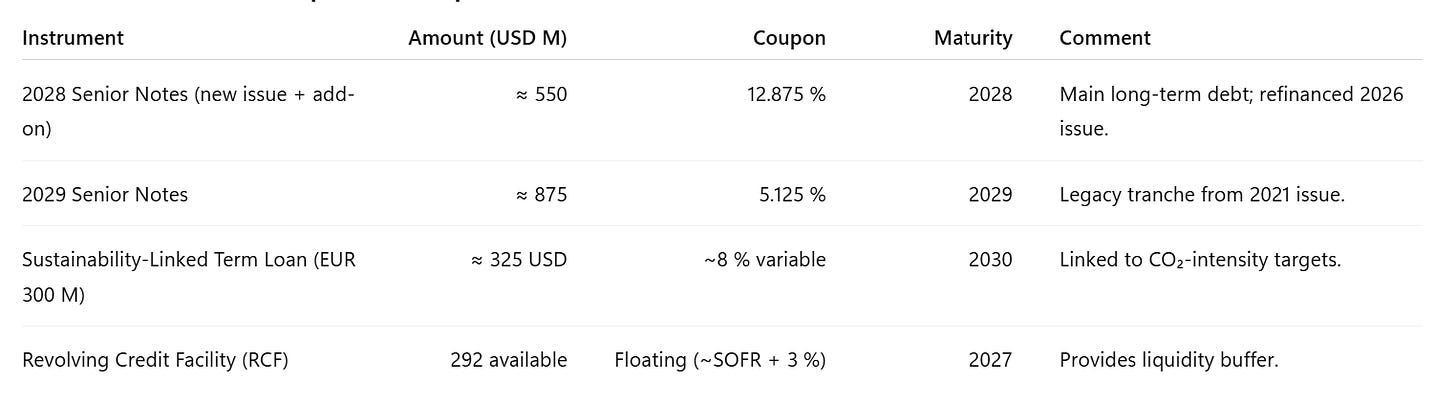

🏦 Debt & Refinancing — The Full Picture (Add-On Section)

Mercer’s debt profile is the heartbeat of its survival strategy — and management has been methodical in extending runway despite the pulp trough.

Refinancing Actions (2024–2025)

In October 2024, Mercer executed a critical refinancing maneuver:

Issued US $200 million of additional senior notes due 2028 carrying a 12.875 % coupon in a private placement.

Proceeds were used to redeem all outstanding US $300 million 5.5 % notes due 2026 on November 1 2024, at par plus accrued interest.

The transaction removed the nearest maturity and pushed the company’s next significant principal payment to 2028.

This step came at a high cost — nearly 13 % — but it bought Mercer three to four years of breathing room, ensuring that liquidity and operations remain stable until the pulp cycle turns.

In early 2025, Mercer complemented this with a new €300 million sustainability-linked term loan, designed to finance decarbonization projects and partially hedge currency risk between its European mills and Canadian operations. The facility carries a step-down coupon if ESG intensity targets are met, making it cheaper than unsecured notes.

Current Debt Structure (post-2025 updates)

Total gross debt ≈ 1.5 B USD.

Weighted average cost ≈ 9.5–10 %.

Cash ≈ 146 M USD → Net debt ≈ 1.35 B USD.

Covenants and Security

The 2028 and 2029 notes are senior unsecured, but guaranteed by most operating subsidiaries. The RCF and the sustainability loan are secured, primarily by receivables, inventories, and the German mill complex (Stendal).

Covenant headroom remains reasonable: net leverage limit ≈ 4.5×, interest coverage > 2.0×. Current levels sit just below these thresholds but trending stable.

Liquidity Outlook

No near-term maturities until 2028.

RCF provides a reserve of US $292 million.

Planned asset-sale or minority divestment (energy/timber segment) could raise an additional 150–250 M USD, easily covering annual interest.

Fitch and S&P both highlight “adequate liquidity” post-refinancing; rating B- stable (S&P, Apr 2025).

What It Means

The refinancing cycle confirms two things:

Management will pay up for survival — but they won’t let maturities choke operations.

With no major debt walls before 2028, Mercer can absorb another 12–18 months of pulp weakness without breaching covenants.

Fragments Read

In pure deep-value terms, debt is the market’s blind spot here.

Most investors see the 12.875 % coupon and panic; we see optionality bought with time.

This structure gives Mercer the chance to monetize assets or ride the next pulp upswing before any real solvency test arrives.

It’s expensive debt, yes — but it converts short-term fear into a long-term call option on tangible mills, land, and power assets.

🧠 Premium Unlock — The Real Deep Value Math

The full Sum-of-the-Parts valuation, cycle scenarios, insider signals, and our conviction roadmap are below the fold.👉 Upgrade to Fragments Plus to access the complete Mercer Deep-Value Report — full valuation tables, catalysts, and our bottom-line target.

Between the lines: The market sees pulp dust and heavy coupons — but that’s not what’s really trading here.

Mercer is now a leveraged play on tangible mills, cheap power, and time.

Every year the market prices it for bankruptcy… and every cycle, it survives.The real question isn’t if the pulp turns — it’s when.

And when it does, this setup won’t trade at book value anymore.🔒 What’s below the fold:

• Full Sum-of-the-Parts valuation (Bear / Base / Bull)

• Catalysts & refinancing timeline

• Ownership concentration & insider signals

• “Fragments View” conclusion — why this setup still matters